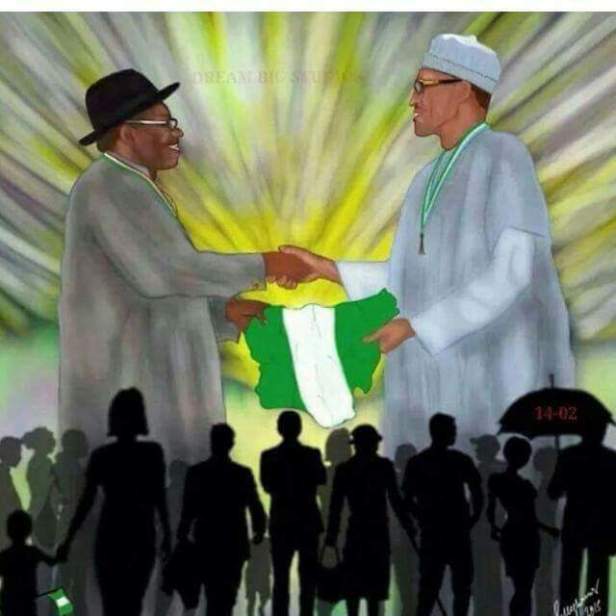

As General Muhammadu Buhari (rtd) sat in

front of the TV watching his election

victory unfold, the future president took

care to be photographed beside a Muslim

Cleric and a bishop,a

statement of unity in a religiously mixed

nation.

More importantly for investors, over the

left shoulder of the purple-robed bishop

was a smiling figure in a sharp grey suit:

Aliko Dangote, the most celebrated

business magnate and Africa’s richest

man.

An ascetic former military ruler, Buhari

built his stunning electoral landslide on

promises to clean up the country’s

notoriously filthy politics and get tough

on the Boko Haram insurgency raging in

the northeast.

He returned to those themes in his first

official speech as president elect,

stressing a zero tolerance approach to

corruption and saying he would “spare

no effort” to defeat the Islamist

militants who have killed thousands in

the northeast.

It is less clear what his victory means for

Africa’s biggest economy, under pressure

from the collapse in the oil price, but

Dangote’s grinning, capitalist presence

in the sandal-wearing general’s inner

circle at his moment of triumph looks

reassuring.

In the most glaring endorsement of

Buhari – as well as relief that the

elections avoided the violence of

previous polls – the stock market leapt

more than 8 percent in the immediate

aftermath of his win.

Bonds also climbed, while the naira,

which has lost 20 percent of its

purchasing power in two devaluations

since November, gained 0.5 percent on

the black market to 217 to the dollar. It

remained fixed at 197 in official

interbank trade.

‘New Buharism?’

This is not to say all is set fair for the

72-year-old, whose last time in office

was 20 months as a military dictator in

the mid-1980s.

Then, his response to a yawning trade

gap and runaway inflation was to fix

prices and ban “unnecessary” imports,

rather than let the currency depreciate,

under an economic programme

dubbed ‘Buharism’.

For good measure, he also cut ties with

the International Monetary Fund and

ordered his soldiers to instill descipline on people who

failed to form orderly queues at public spaces like bus

station.

Buhari’s political views have mellowed

since then, and his relationship with

Dangote, whose business empire stretches

from cement to pasta, suggests his

economic ones have gone the same way.

But he faces many dark clouds on the

horizon.

From President Goodluck Jonathan, who

stunned Nigeria’s 170 million people with

a gracious concession speech, Buhari

inherits an economy decelerating

sharply from the 7 percent annual

growth to which it has become

accustomed.

Standard and Poor’s cut Nigeria’s credit

rating two weeks before the vote and

Fitch lowered its outlook on the eve of

the polls – both moves that will increase

Abuja’s borrowing costs.

Meanwhile, the oil price languishes at

around $55 a barrel, half its level of a

year ago and a massive blow to a

country that relies on crude sales for 80

percent of government revenues and 95

percent of foreign exchange.

Outside the capital, huge road-building

projects lie deserted and half-finished

and cranes stand idle across its skyline,

testament to a construction sector pole-

axed by the government’s difficulty in

paying its bills.

Foreign reserves have dropped by a

third in the last year to below $30

billion.

Against such a backdrop, Buhari – now

free of the need to get elected – will

have few options but to cut Nigeria’s

cloth to a more appropriate size,

analysts say.

“Nigeria has been postponing a really

important macro-economic adjustment

because of the sensitivity of voters,”

said Jan Dehn, head of research at

Ashmore Group, an emerging markets

investment manager. “That’s really

critical for investors.”

‘Least awful’

In practical terms, that means cutting

government spending, hammering the

corruption that overshadows every facet

of life, and letting the naira find a

more stable – and lower – footing to

stem the bleeding of central bank dollar

reserves.

“The currency still needs to adjust to

take into consideration lower oil prices,”

said Claudia Calich, an emerging bond

fund manager at M&G Investments in

London. “The earlier they do this, the

better.”

Others said Buhari could be forced to

take the unpopular move of hiking taxes

to plug the gap left by oil receipts.

“We expect a reformist administration

that will impose austere policies,” said

Yvonne Mhango, an economist at

Renaissance Capital in Johannesburg.

“Limited fiscal resources imply upside

risk to taxes.”

Meanwhile, Nigerians who for the

first time realised the power of an

unfettered ballot box will be breathing

down his neck demanding results –

especially since voting was in many cases

anti-Jonathan rather than explicitly

pro-Buhari.

In a scathing Economist editorial that

will not have been lost on many

Nigerians, the magazine grudgingly

endorsed Buhari as merely the ‘least

awful’ of the two choices put before

them.

“It’s not so much that people love

Buhari. But they were tired of this

stagnation, this lack of movement, this

seeming cluelessness of administration,”

said political analyst Ebun-Olu

Adegboruwa.

“It’s not so much ‘Hosannah,

Hosannah’. People will be crying ‘Crucify

him’ if he’s unable to perform.

views expressed are not necessarily the opinion of blog author.

Discover more from IkonAllah's chronicles

Subscribe to get the latest posts sent to your email.